If you have an online payment processor by which CoachAccountable can accept payments on your behalf, you'll find the ability to set a price for your Offerings.

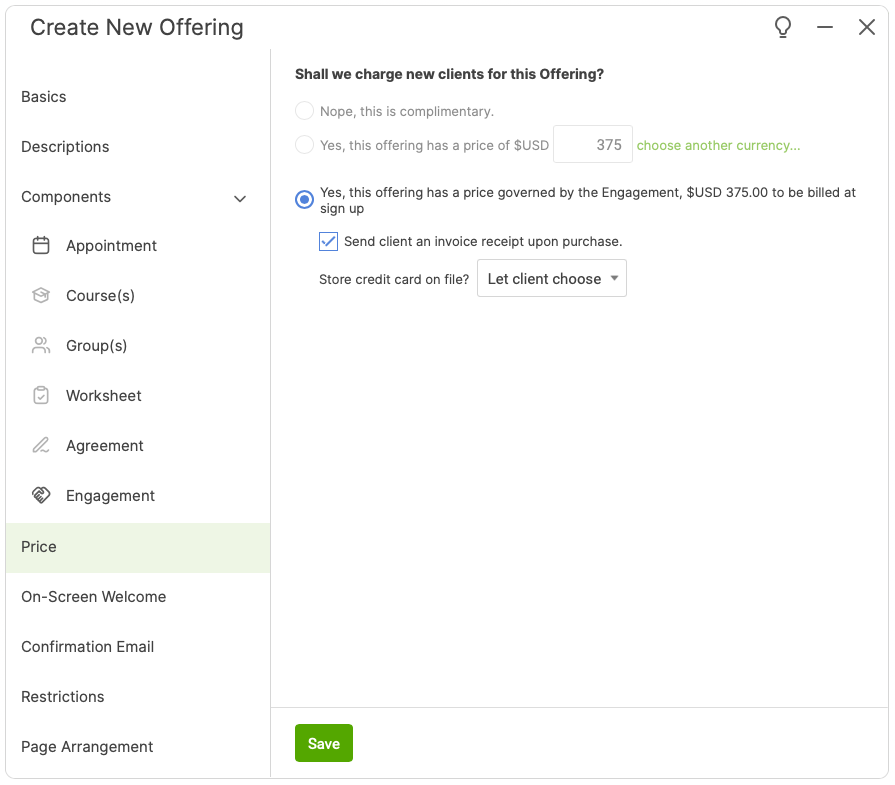

Here is what the options for setting that up look like:

As you can see, Offerings pricing can be set in one of three ways:

- Free, such as for a complimentary discovery call

- One-time pricing, such as paying for a single session

- Governed by an Offering Engagement

- Note this option will appear only if you have an Engagement Template that entails an immediate invoice tied to the Offering.

You'll note that there's the option to send an invoice receipt email to your new clients at the time of sign-up. This message is in addition to the Welcome email you may have set, so it's up to you to determine whether it makes sense to send two emails.

Storing Cards on File

If you're using Stripe or Square for your online payment processor, it's possible to store customer cards on file for future transactions. In that case, you can choose to either store the client's credit card or allow the client to choose whether the card should be stored for future purposes. You, as coach, are responsible for properly informing the client if you're storing their cards for future automatic billing.

What about taxes when someone purchases an Offering?

You'd calculate the tax amount into the Offering price itself. Since the pricing for Offerings supports only a single price, there is no way to indicate tax portions.

However, if you need to have taxes broken out as part of the invoices, there is a workaround: to have the price of an Offering governed by an Engagement that is part of it. This happens whenever an Offering entails an Engagement, the template for which implies an immediate invoice (i.e., that third option shown above).

If you create a special-purpose Engagement Template for just this purpose to tie to a given Offering, you can define whatever line items AND a tax amount in that Engagement's Invoicing Plan, and that is how the invoice for the Offering will be generated.